Real-Time Tax Insights: Monitor Your Liability Year-Round with Our Cloud Platform

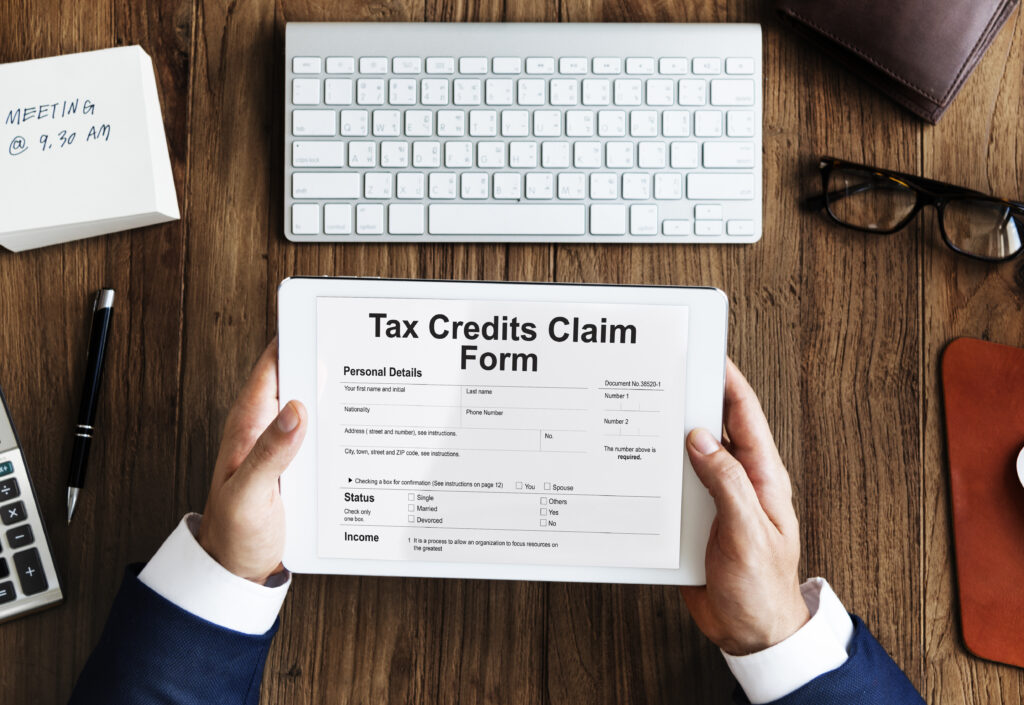

If you are a small business owner, sole trader or freelancer then it’s likely that you’re responsible for filing your own tax return. Unfortunately, filing your taxes can be complicated and time consuming. It is also easy to make mistakes which can lead to fines from HMRC (Her Majesty Revenue & Customs).

Our qualified accountants will provide you the necessary advice and guidance on how to minimise your tax liability so that you can focus on what matters most – growing your business!

We will work with you to ensure your tax return is filed on time and correctly. Our team of experts have years of experience helping people just like you file their UK Tax returns accurately and efficiently so that they don’t fall foul of the authorities!

By returning tax accurately one ensures his/her adherence to UK tax laws and regulations. It prevents him/her from legal issues or penalties

Self-Assessment Tax Return provides a comprehensive overview of your taxable income. It helps you to plan better for financial future and decision-making

Self-Assessment Tax Return provides a comprehensive overview of your taxable income. It helps you to plan better for financial future and decision-making

Filing a Self Assessment Tax Return can be stressful and time-consuming—but it doesn’t have to be. At Cloud Accounting, we make the process simple, accurate, and fully compliant with HMRC regulations. Here’s why individuals, freelancers, landlords, and small business owners trust us with their tax return needs:

We take care of the entire process for you—from gathering the required information to submitting your return to HMRC. No paperwork, no confusion, and no last-minute panic.

Whether you're self-employed, a landlord, or earning additional income, we tailor our service to your unique financial situation—ensuring you claim every allowable expense and relief.

Our tax professionals are well-versed in current HMRC rules and requirements. We ensure your return is submitted accurately and on time, reducing the risk of fines or errors.

No hourly rates or unexpected add-ons. With our fixed-fee pricing, you get a clear understanding of costs upfront, with no surprises along the way.

Send your documents and communicate with us from the comfort of your home. Our secure, cloud-based system means fast, paperless service and safe data handling.

Once we file your return, we provide full confirmation and HMRC submission receipts—giving you the confidence that everything’s been done correctly.

In the complicated field of UK tax law, having a reliable partner like Cloud Accounting can be the difference maker. Our help will maximize your financial potential.

From engaging with advanced solutions to providing expert advice, we assure that your Self Assessment Tax Return process is as smooth and beneficial as possible

Accurate, up-to-date bookkeeping that keeps your finances organised and ready for decision-making.

Simple, compliant payroll processing — including payslips, RTI submissions, pensions, and more.

Messy accounting records? We’ll fix past errors, organise your accounts, and bring everything up to date.

We manage your online business finances, track sales, and keep your accounts accurate and tax-ready.

WhatsApp us