Industry Expertise

Our specialized knowledge in serving Vat Returns ensures we understand your unique financial challenges and opportunities.

HMRC

Expertise

Our team stays up-to-date with the latest HMRC regulations, ensuring full compliance and minimizing your tax liabilities.

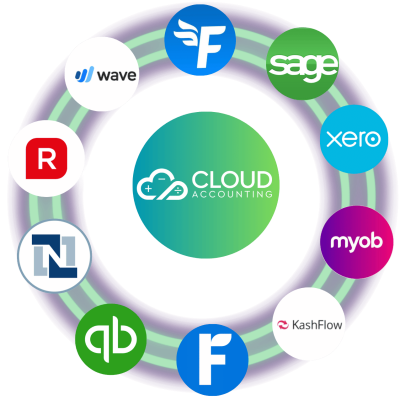

Cloud-Based App

Proficiency

We leverage cutting-edge cloud accounting software to provide real-time financial insights and seamless collaboration

Time Saving

By automating and optimizing your accounting processes, we help reduce operational costs, directly impacting your bottom line