Optimize Your Cash Flow and Minimize Debt with Cloud Accounting Professional Credit Control Solutions

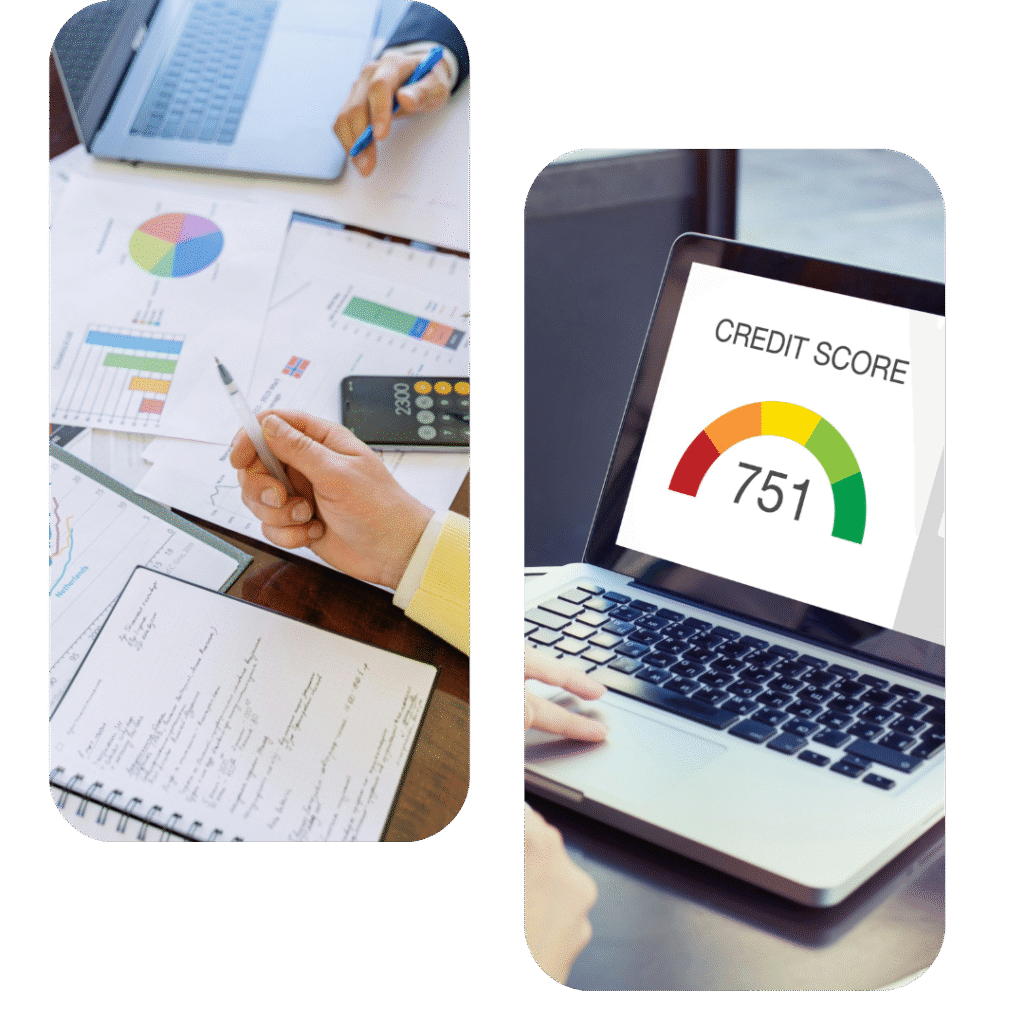

Credit control in the UK is vital for businesses to maintain healthy cash flow and minimize bad debts. It involves setting credit policies, conducting customer creditworthiness assessments, and managing payment collections. UK companies often use credit reference agencies and specialized software to streamline these processes.

The practice encompasses establishing clear payment terms, regular account monitoring, and prompt follow-up on overdue payments. Legal frameworks, such as the Late Payment of Commercial Debts (Interest) Act 1998, support businesses in their credit control efforts, allowing them to claim interest on late payments from business customers.

Effective credit management not only improves financial stability but also fosters strong customer relationships. It’s backed by UK insolvency laws and debt recovery procedures, providing companies with options for recovering unpaid debts, including legal action when necessary. This comprehensive approach helps UK businesses maintain financial health and support growth.

Effective credit management plays a vital role in the financial health and sustainability of any business.

A well-structured credit control process guarantees a consistent inflow of cash, enabling smooth day-to-day operations and maintaining essential liquidity.

By proactively monitoring and managing credit, businesses can significantly minimize the risk of bad debts, avoiding the financial strain and administrative burden of debt recovery.

Clear communication and timely payment practices help build trust with customers, fostering long-term partnerships and mutually beneficial business relationships.

At Cloud Accounting, we provide professional Credit Control services designed to protect your cash flow, reduce bad debt, and strengthen customer relationships. Our approach is both strategic and people-focused, ensuring that your business stays financially healthy without compromising client trust.

We begin by reviewing your existing credit management process, identifying gaps, and creating tailored solutions that work for your industry and customer base. Our comprehensive services include:

Assess the creditworthiness of new and existing customers to minimise financial risk.

Create clear, enforceable payment terms aligned with your business objectives.

Send timely, professional reminders that encourage prompt payments while preserving goodwill.

ollaborate with late-paying customers to agree on realistic repayment plans.

Receive regular, easy-to-read updates on overdue invoices and payment trends.

Recover overdue payments efficiently using compliant and professional processes.

With Cloud Accounting’s credit management solutions, you can expect reduced late payments, improved cash flow, and more time to focus on growing your business. Our team combines industry best practices with a human approach—making credit control simple, effective, and stress-free.

When you choose Cloud Accounting for your Credit Control needs, you’re partnering with a team of experts dedicated to strengthening your business’s financial health. We combine industry knowledge, personalised strategies, and cutting-edge technology to deliver solutions that protect your cash flow, reduce bad debt, and help your business thrive.

Here’s why businesses trust us:

Effective Credit Control is non-negotiable in ensuring the financial stability and growth of your

business. At Cloud Accounting, we are dedicated in providing a service that meets and exceeds

your expectations. We will be driving your business towards greater success. Our results oriented approach to Credit Management makes us the ideal partner for UK businesses seeking to

secure their financial future

Accurate, up-to-date bookkeeping that keeps your finances organised and ready for decision-making.

Simple, compliant payroll processing — including payslips, RTI submissions, pensions, and more.

We manage your online business finances, track sales, and keep your accounts accurate and tax-ready.

Self-employed or have other income? We handle personal tax returns and make sure nothing’s missed.

WhatsApp us