Master Xero Practical Accounting Training to streamline your business finances. Learn essential features for real-world financial success with our practical xero training. Join today!

Years Experience

Training Provided

Courses Avilable

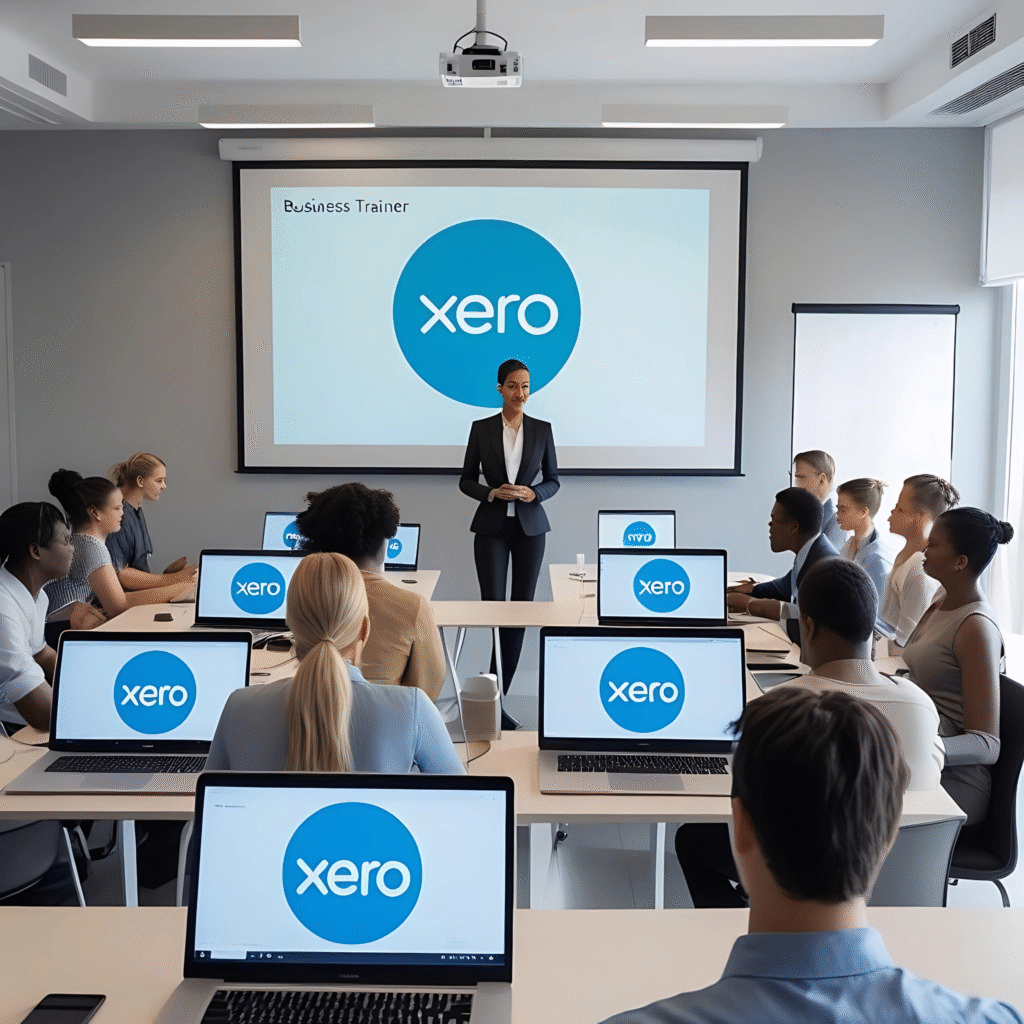

Ready to take your Xero skills to the next level? At Cloud Accounting, our Xero Practical Accounting Training is designed for professionals and business owners seeking hands-on expertise. This practical xero training course combines essential theory with real-world application, covering core tasks like managing sales, purchases, VAT returns, and bank reconciliations, as well as advanced topics such as payroll, fixed assets, accruals, and management reporting.

Led by experienced accountants who use Xero daily, our practical xero training ensures you gain relevant, practical skills to apply immediately in your career or business. Whether you’re an accountant looking to sharpen your skills or a business owner aiming to improve financial oversight, our course equips you with the tools and confidence to succeed.

Live online training via Zoom, available for participants worldwide.

Classroom-based training delivered at locations across the UK.

Onsite training available at your premises, anywhere in the world.

Personalised one-to-one training with a certified Xero advisor.

Group training sessions available onsite or live online via Zoom.

£1400 (Online Live Via Zoom)

£1600 (Classroom)

We offer flexible options—live online, onsite, classroom, or one-to-one—tailored to your needs. Whether you’re a beginner or advanced user, our certified trainers provide practical, hands-on guidance. Contact us today to find the right practical xero training solution for you or your team.

Our other Xero training courses cover a range of topics to support different business needs. Whether you’re looking to improve your understanding of invoicing, bank reconciliation, reporting, or advanced features, we have specialized courses to help you make the most of Xero. These sessions are designed for users at all levels and can be tailored to suit your specific goals and industry requirements.

Xero Training for Charities and Non-Profits gives real-time insights into your funds, projects, and overall performance.

Alongside our standard Xero courses, we offer bespoke training tailored to your specific needs, using real or demo data.

Our payroll training keeps you updated on the latest rules, so you can manage payroll confidently and accurately.

Xero training for business owners builds bookkeeping skills, helping them stay on top of their finances at all times.

This training is ideal for beginners, small business owners, bookkeepers, or anyone new to Xero looking to build a strong foundation.

No prior accounting experience is needed. We start with the basics and guide you step by step.

No prior knowledge is required. This training is designed for beginners and will guide you through the basics of Xero Accounting.

Training is available online via Zoom, onsite at your location, in classrooms across the UK, or in one-to-one sessions.

Basic training typically runs from 2 to 4 hours, depending on the format and individual or group needs.

Yes, we provide access to a demo version of Xero so you can practice tasks in real time.

Yes, participants receive a certificate of completion at the end of the training.

Absolutely. One-to-one and onsite sessions can be customised to fit your specific business setup and goals.

WhatsApp us