When a business moves to a powerful ERP like NetSuite, one of the most critical and technical steps is the NetSuite GL Migration the process of transferring your entire general ledger data into NetSuite. This includes every account, transaction, opening balance, and adjustment that defines your company’s financial story.

Many businesses underestimate how pivotal the general ledger is. It’s not just a list of debits and credits; it’s the foundation of every financial report, forecast, and compliance audit. If your NetSuite GL Migration isn’t handled carefully, even small errors can ripple across financial statements, leading to mismatched balances, reporting delays, and compliance risks.

That’s why understanding how NetSuite GL Migration works — and planning it correctly — is essential. Whether you’re upgrading from legacy accounting software or consolidating multiple entities into NetSuite, getting your general ledger migration right ensures your financial data stays clean, compliant, and ready for strategic decision-making.

What Is NetSuite GL Migration?

NetSuite GL Migration is the process of moving your general ledger—the core of your financial system—from your current accounting or ERP software into NetSuite. It covers all your financial records, including revenue, expenses, assets, liabilities, and equity, ensuring your business’s financial history is preserved in NetSuite.

The process involves mapping and validating key components such as:

- Chart of accounts: Account codes and hierarchy.

- Opening/closing balances: Matching past financial periods.

- Journals and adjustments: Maintaining transaction accuracy.

- Multi-entity or currency data: Managing subsidiaries and foreign exchange balances.

A successful migration doesn’t just copy data—it refines and aligns your GL with NetSuite’s structure, creating a reliable, audit-ready financial foundation. Because the GL connects to every NetSuite module, it’s often the first and most vital phase of a full migration project.

When Should You Migrate Your General Ledger to NetSuite?

Timing is everything when it comes to NetSuite GL Migration. Migrating your general ledger at the right moment can save your finance team countless hours of reconciliation, prevent reporting delays, and ensure a clean start in your new ERP system.

There are several key moments when businesses typically decide to migrate their GL to NetSuite:

- At the start of a new financial year

This is the most common and recommended time for NetSuite GL Migration. It allows you to close your books in your old system and begin a fresh, clean ledger in NetSuite from day one of the new year. - During a system upgrade or consolidation

If your company is moving from a legacy ERP or merging multiple entities into one system, migrating the general ledger ensures consistency and eliminates duplicate financial structures. - Before a major audit or compliance change

For companies preparing for audits, IPOs, or regulatory transitions (such as IFRS or local GAAP updates), a NetSuite GL Migration provides a modern, compliant structure with better visibility and traceability. - After a data clean-up or restructuring

If your existing ledger has grown complex or inconsistent over time, performing a clean-up before migration can make the NetSuite GL Migration far smoother — reducing manual corrections later. - When scaling for growth

Fast-growing businesses often outgrow their old systems. NetSuite’s general ledger allows for multi-entity, multi-currency, and real-time reporting — features older systems simply can’t match.

The best time for NetSuite GL Migration is when your data is clean, your books are closed, and your finance team has the capacity to focus on validation and testing. Rushing this step can lead to downstream issues in financial reporting and audit readiness.

Data You’ll Need to Prepare Before Migration

How to get your financial data ready for a smooth NetSuite GL Migration

Before any NetSuite GL Migration, careful data preparation is what determines whether your project succeeds or struggles. Migrating the general ledger isn’t just about exporting data from one system and importing it into another — it’s about cleaning, structuring, and validating it so that NetSuite can read it accurately.

Here’s what your finance and accounting teams should prepare in advance:

1. Chart of Accounts (COA)

Review your existing chart of accounts to identify redundancies, inactive codes, or inconsistent naming conventions. Clean up unnecessary accounts and ensure every GL code has a clear, logical purpose before mapping it to NetSuite.

2. Historical Trial Balances

Gather all trial balances for the periods you want to migrate. These should include both opening and closing balances, ensuring NetSuite reflects accurate historical figures once the migration is complete.

3. Journal Entries and Adjustments

Extract all approved journal entries — including accruals, prepayments, and adjusting entries. Each should be reviewed for accuracy, classification, and completeness before migration.

4. Subsidiary and Entity Data

If your organisation operates across multiple entities, prepare data for each subsidiary separately. NetSuite GL Migration requires clear identification of intercompany accounts and currency conversions to ensure consolidation accuracy.

5. Account Balances by Date

Compile balances as of your migration cutover date (for example, 30 June or 31 December). These figures will serve as your opening balances in NetSuite.

6. Audit Trails and Supporting Documentation

Keep your source data and reports easily accessible. Auditors or stakeholders may need to verify that migrated figures match your legacy system’s reports.

7. Data Templates for Import

NetSuite supports importing GL data via CSV templates or APIs. Ensure your data follows the correct structure — with columns for account codes, amounts, currencies, and periods — to avoid upload errors.

Preparing these elements before your NetSuite GL Migration reduces risk, saves time, and ensures you can validate results quickly once the data lands in NetSuite.

The Step-by-Step Process of NetSuite GL Migration

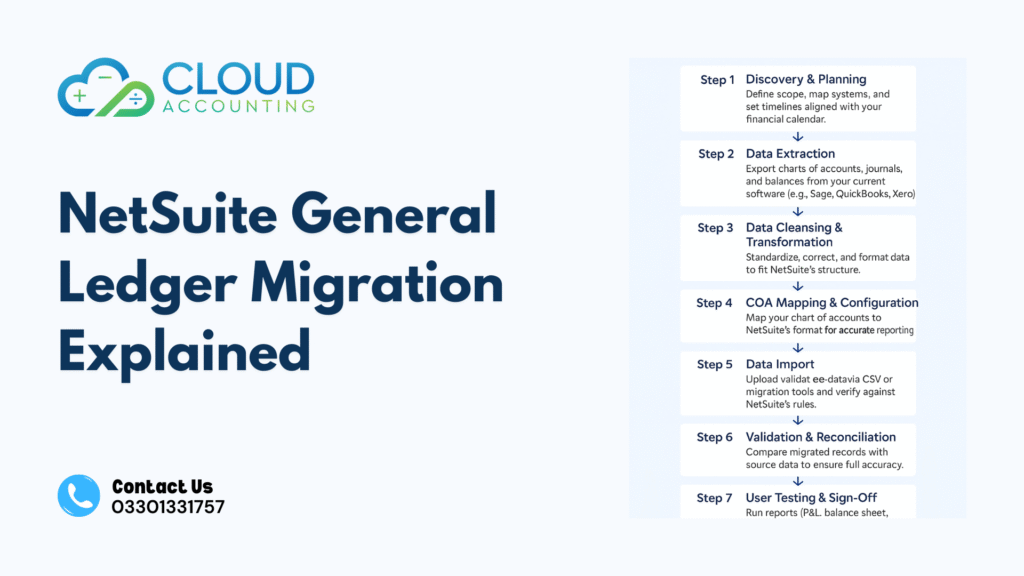

Migrating your general ledger into NetSuite follows a precise, structured path to ensure data accuracy and system alignment. Here’s the short version:

Step 1: Discovery & Planning

Begin by defining the project scope, mapping your existing systems, and setting clear timelines that align with your financial calendar.

Step 2: Data Extraction

Next, export your chart of accounts, journals, and balances from your current software—whether that’s Sage, QuickBooks, Xero, or another ERP.

Step 3: Data Cleansing & Transformation

During this stage, standardize and correct your data, merging duplicates and formatting it to fit NetSuite’s structure.

Step 4: COA Mapping & Configuration

With clean data in hand, align your chart of accounts to NetSuite’s format to ensure accurate reporting and future scalability.

Step 5: Data Import

After mapping, upload the validated data through CSV templates or migration tools, checking each record against NetSuite’s validation rules.

Step 6: Validation & Reconciliation

Then, compare the migrated data with your source records to verify totals, trial balances, and retained earnings.

Step 7: User Testing & Sign-Off

Once validated, run key financial reports—P&L, balance sheet, and cash flow—to confirm everything performs as expected before sign-off.

Step 8: Go-Live & Review

Finally, move live in NetSuite, review dashboards, and monitor performance during the first reporting cycle to ensure everything runs smoothly.

A well-run NetSuite GL Migration transforms your financial system—building a single, reliable source of truth for future reporting.

Common Challenges During NetSuite GL Migration

Recognising the pitfalls that can delay or derail your NetSuite GL Migration

Even with careful planning, a NetSuite GL Migration can present unexpected challenges. Understanding these common issues early helps you plan ahead and avoid costly errors during implementation.

1. Inconsistent or Incomplete Source Data

One of the biggest obstacles in any NetSuite GL Migration is poor data quality. If your existing system contains duplicate accounts, incorrect balances, or missing journal entries, those issues will carry over into NetSuite. It’s crucial to cleanse and reconcile your data before extraction.

2. Poor Chart of Accounts Mapping

Mapping your old chart of accounts to NetSuite’s structure requires careful design. Misaligned account types or missing categories can cause discrepancies in financial reports. A clear mapping document and validation checks are key to preventing this problem.

3. Limited Understanding of NetSuite’s GL Structure

NetSuite’s general ledger is more flexible and complex than traditional accounting systems. Without a full understanding of its segment structure, classification rules, and multi-entity setup, it’s easy to configure things incorrectly — leading to errors in consolidation or reporting.

4. Overlooking Historical Adjustments

Many businesses focus only on open balances when performing NetSuite GL Migration, forgetting about historical adjustments, accruals, or corrections. Skipping these can result in mismatched retained earnings or inaccurate year-to-date figures.

5. Inadequate Testing and Validation

Testing is often underestimated. Without validating every trial balance and report, you risk going live with inaccurate data. Proper testing ensures your NetSuite GL Migration results in fully reconciled, audit-ready accounts.

6. Lack of Communication Between Teams

Finance, IT, and external consultants must collaborate closely during migration. A lack of coordination can lead to delays, missed dependencies, or conflicting updates. Clear documentation and defined responsibilities prevent these issues.

7. Rushing the Migration Timeline

Trying to complete the migration too quickly — especially near a reporting deadline — can lead to errors that take much longer to fix later. It’s better to build extra time for validation and corrections than to rush the process.

Addressing these challenges upfront helps ensure your NetSuite GL Migration runs smoothly, protects data accuracy, and sets your business up for long-term financial clarity in NetSuite.

How to Ensure Accuracy and Compliance

Safeguarding data integrity during your NetSuite GL Migration

Accuracy and compliance are the heart of any successful NetSuite GL Migration. Even small discrepancies in migrated data can lead to material misstatements in financial reports or audit complications later. That’s why businesses must prioritise accuracy, transparency, and control throughout the process.

Here’s how to achieve it:

1. Conduct a Pre-Migration Audit

Before starting the NetSuite GL Migration, review your existing general ledger thoroughly. Identify discrepancies, missing entries, or unbalanced accounts. A pre-migration audit ensures that only clean, verified data moves into NetSuite.

2. Validate Your Chart of Accounts

Ensure your COA aligns with NetSuite’s classification logic — including account types (asset, liability, equity, income, expense), sub-accounts, and dimensions. This validation step helps maintain consistency between systems and ensures accurate reporting post-migration.

3. Use Automated Reconciliation Tools

Automation significantly improves accuracy. Many migration specialists use reconciliation tools or custom scripts to compare trial balances, detect mismatches, and flag rounding or exchange-rate differences automatically.

4. Follow Data Governance Best Practices

Maintain strict control over who can modify, approve, and upload data during migration. Using version control and documented approval workflows ensures full traceability — essential for audit compliance.

5. Test with Parallel Runs

Run both systems (old and new) side by side for one or two accounting periods. Compare reports such as trial balances, P&L statements, and balance sheets. This double-run approach confirms that your NetSuite GL Migration reflects the same financial position as your legacy system.

6. Keep an Audit Trail

Preserve detailed migration logs, including import files, validation results, and reconciliation reports. This audit trail demonstrates compliance to auditors, stakeholders, and regulators if questions arise later.

7. Partner with Certified NetSuite Migration Experts

Finally, ensure your NetSuite GL Migration is guided by experts familiar with both accounting and NetSuite ERP. Certified specialists understand how to maintain compliance, handle complex mappings, and meet local reporting standards (such as IFRS or GAAP).

Best Practices for Smooth NetSuite GL Migration

Expert tips to make your NetSuite GL Migration faster, cleaner, and more reliable

Executing a successful NetSuite GL Migration requires more than just technical accuracy — it’s about strategy, collaboration, and timing. Whether you’re migrating from Sage, QuickBooks, Xero, or another ERP, following proven best practices ensures a smoother transition and reduces post-go-live headaches.

1. Start with a Clear Migration Strategy

Before touching any data, define your migration objectives, scope, and cutover plan. Decide whether you’ll move summary-level data, full transaction history, or a hybrid approach. A clear plan keeps your NetSuite GL Migration focused and manageable.

2. Clean and Simplify Your Chart of Accounts

Don’t migrate clutter. Use this opportunity to simplify your chart of accounts by merging duplicate or inactive accounts. A clean COA enhances reporting clarity and makes NetSuite’s financial dashboards more powerful.

3. Perform Incremental Testing

Instead of uploading all data at once, test in stages. Import smaller batches of trial balances or journals to confirm accuracy before scaling up. This step-by-step validation approach is safer and helps your team catch issues early.

4. Document Every Mapping and Decision

Maintain detailed documentation for all COA mappings, data transformations, and configuration choices. These records not only support future audits but also help internal teams understand the new NetSuite GL structure.

5. Involve Your Finance Team Early

Your accountants and finance leaders know the nuances of your ledger better than anyone. Involving them early ensures the NetSuite GL Migration aligns with internal reporting needs, not just technical requirements.

6. Schedule the Migration Around Low-Activity Periods

Choose a period when your accounting team isn’t closing books or handling audits. Performing a NetSuite GL Migration during quieter times reduces pressure, minimises disruption, and allows more focus on testing and reconciliation.

7. Validate Reports Immediately After Import

As soon as your data lands in NetSuite, generate and compare key reports — trial balance, balance sheet, profit and loss — with your legacy system. Immediate validation ensures you catch inconsistencies before go-live.

8. Work with a Certified NetSuite Migration Partner

Partnering with specialists who handle NetSuite GL Migration regularly ensures that your data, structure, and reporting standards are configured correctly. Expert oversight helps avoid costly rework and accelerates the go-live timeline.

Following these best practices transforms your NetSuite GL Migration from a technical challenge into a controlled, strategic upgrade — giving you clean, trusted financial data ready for decision-making in NetSuite.

Why Businesses Choose Cloud Accounting for NetSuite GL Migration

Partnering with experts who make NetSuite GL Migration simple, secure, and accurate

When it comes to NetSuite GL Migration, precision and expertise matter. At Cloud Accounting, we help businesses migrate their general ledger data with complete accuracy — ensuring every balance, journal entry, and account code lands perfectly in NetSuite.

Our team combines accounting knowledge, data migration experience, and ERP system expertise to deliver migrations that are technically sound and audit-ready. Here’s why growing companies trust us with their NetSuite projects:

1. Accounting-Led Migration Approach

Unlike generic IT migration firms, we’re accountants first. We understand financial reporting, reconciliations, and compliance requirements — meaning your NetSuite GL Migration is guided by professionals who speak both finance and technology.

2. End-to-End Migration Management

We handle the entire process — from planning, data extraction, and transformation to validation and post-migration review. Our structured approach reduces risk and gives you full visibility at every stage of your migration journey.

3. Custom Mapping and Validation Tools

Our specialists use advanced mapping templates and reconciliation scripts to ensure that every figure matches your legacy system. This means zero balance discrepancies and full traceability during audits.

4. Expertise Across Multiple Platforms

Whether you’re moving from Sage, QuickBooks, Xero, or another ERP, we tailor your NetSuite GL Migration process to suit your source system’s structure — ensuring data accuracy across every chart of accounts and subsidiaries.

5. Multi-Entity and Multi-Currency Experience

We’ve managed complex NetSuite GL Migrations involving international entities, multiple currencies, and consolidated reporting. We ensure your NetSuite setup aligns perfectly with your global structure and compliance standards.

6. Ongoing Support and Optimization

Our relationship doesn’t end at go-live. We provide post-migration support, training, and system optimization to help your finance team make the most of NetSuite’s advanced reporting and automation features.

When you partner with Cloud Accounting, you’re choosing more than a migration provider — you’re choosing a trusted financial technology partner committed to accuracy, compliance, and long-term success in NetSuite.

Final Thoughts on NetSuite GL Migration

A NetSuite GL Migration isn’t just another data task — it’s the foundation of your company’s financial future. Every account, journal entry, and balance you migrate determines the accuracy of your reports, forecasts, and compliance down the line. Getting it right from the start means your business can rely on NetSuite for clear, confident decision-making.

By preparing your data carefully, validating every figure, and working with an experienced migration partner, your transition to NetSuite can be smooth, transparent, and fully compliant.

At Cloud Accounting, we specialise in helping businesses perform accurate, audit-ready NetSuite GL Migrations from single-entity setups to multi-subsidiary global structures. Our team ensures that your general ledger is not only transferred securely but also optimised for NetSuite’s powerful reporting and automation capabilities.

Book Your Free NetSuite Migration Consultation Today. Don’t risk errors or downtime with DIY data transfers. Our certified NetSuite migration specialists handle every step from data extraction to final validation so your financials stay accurate and audit-ready.