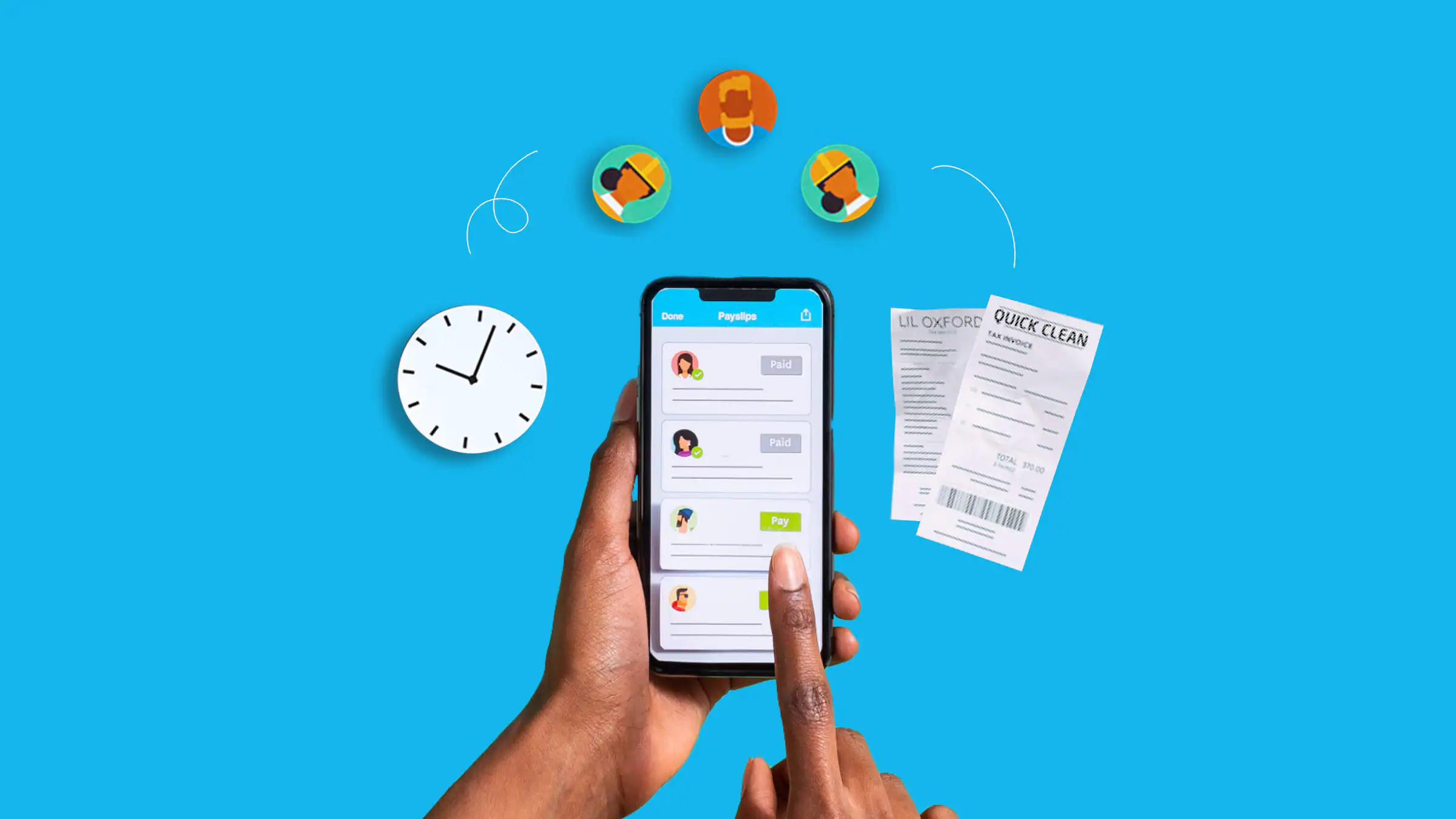

Your Trusted Partner for Smooth and Stress-Free Accounting Platform for Xero Payroll Setup. Setting up Xero Payroll correctly is essential for smooth and compliant payroll processing. We provide expert Xero Payroll setup tailored to your business needs—configuring pay items, employee details, tax settings, and leave types. Our service ensures accurate payroll runs, HMRC compliance, and seamless integration with your accounting in Xero.

Setting up payroll in Xero isn’t just about entering employee details—it’s about getting every setting right so your business stays compliant and your employees are paid correctly. Whether you’re starting fresh or moving from another system, Cloud Accounting provides a professional Xero Payroll Setup service that ensures everything is in place from the start.

We help business owners and accounting professionals implement payroll systems that are accurate, compliant, and integrated with their accounting. From employee setup to tax rules and reporting, we handle the setup so you can focus on managing your team—not fixing payroll issues later.

Our Xero Payroll Setup is a complete service designed to ensure your payroll is ready for live pay runs and meets all local compliance standards. Here’s what we deliver:

We enter all employee information including personal details, tax file numbers, superannuation (where applicable), leave entitlements, and bank details.

We configure all relevant tax settings—such as PAYG withholding, super contributions, and other statutory obligations—based on your location.

We set up weekly, fortnightly, or monthly pay cycles according to how your business pays staff. This includes automation settings and reminders.

We link your payroll directly to your general ledger in Xero so all wages, liabilities, and tax payments are correctly tracked and reported to cloud.

We configure annual leave, sick leave, and other entitlements to match your policies and local labour laws.

We prepare your system for accurate payroll reporting and configure access levels for payroll admins, bookkeepers, and staff.

We don’t offer one-size-fits-all solutions. Our approach is guided by real-world experience, Xero certification, and attention to detail. Whether you’re setting up payroll for a startup or managing a multi-region team, we make sure it’s accurate, compliant, and ready for pay day.

Certified Xero Payroll Advisors with years of experience.

Customised to your workforce structure and pay cycles.

Correct setup of tax deductions and leave entitlements.

Support across Australia, New Zealand, UK & more.

No shortcuts—just clear advice and dependable service.

We set up reporting tools that match your accounting process.

If your business operates across multiple regions or has remote employees overseas, we can help you manage your setup within Xero’s available features. We offer guidance on configuring payroll in different jurisdictions, and when needed, we recommend trusted third-party solutions that integrate with Xero to handle more complex international payroll needs.

Setting up your payroll correctly is critical for employee trust, legal compliance, and business efficiency. Let Cloud Accounting handle the details so you can move forward with confidence

Most setups are completed within 3–5 business days, depending on the number of employees and the complexity of your business structure. We'll give you a clear timeline once we assess your needs.

Yes, our service is specifically for businesses already using or planning to use Xero. If you’re not yet on Xero, we can help you set up a new Xero account as a separate service.

Absolutely. We often assist clients who started payroll themselves and need help correcting tax settings, employee records, or reporting issues.

We currently support payroll setup for businesses operating in Australia, New Zealand, the UK, and other Xero-supported regions. For other locations, we can guide you on integrated third-party tools.

Yes. We offer optional walkthrough sessions to show you how to run pay runs, generate reports, and manage employee records in Xero. Ongoing support is also available.

WhatsApp us